What is value ?

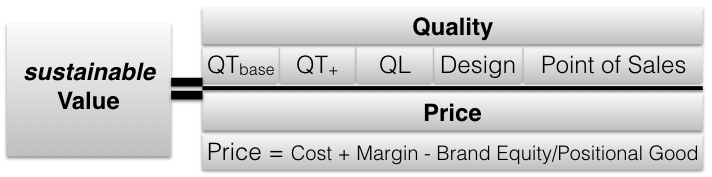

A simple equation

lots of levers

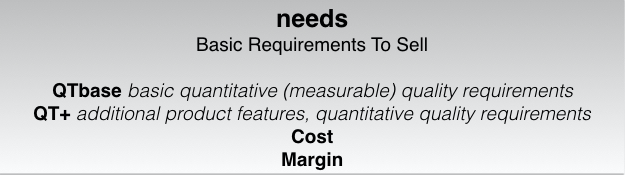

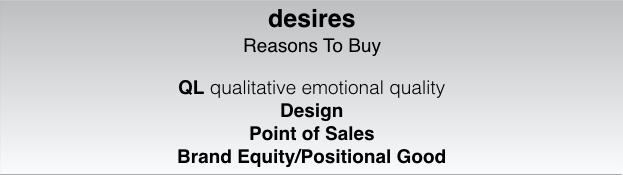

Value is an equation made up of needs, desires, quantitative and qualitative measures. Value is, “what am I getting for my money?”… but because everything is relative, the more the brand equity or the greater the positional good, the less costly it appears to become. So what are high value, low value and niche products?

Delivering value is an end-game: never ever stop until the customer has paid and the desire is visible in their eyes!

And niche products?

Counter-intuitively, high value ‘niche’ products appear to ‘ignore’ some basic quantitative (measurable) qualities, e.g.:

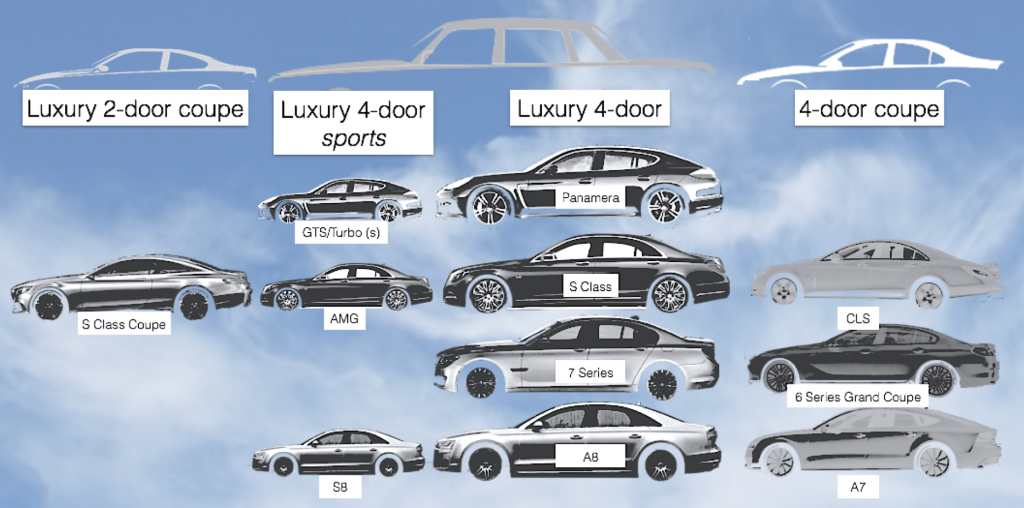

1. cars: rear-seat headroom in a four door coupe vs a standard four door car

2. watches: time-keeping accuracy of a luxury mechanical to a basic quartz watch

…when we say, “we’re prepared to live with it, because of their other ‘qualities’”, we mean that our focus is on key needs or desirables: their design, their brand or positional value, a must have feature or their price-point.

Examples of individual attributes

Where can we see these different types of quality?

The following are real-life examples that show how attention to different aspects of quality fundamentally affects the financial success of a company

Automobile Industry: continued increase in cross-over between more differentiated niche markets.

Differentiation has increased, sometimes to become more subtle…do customers recognise the differentiation and do they value it?

Qualitative (emotional) quality QL is independent of price, although associated with being expensive. It’s more than basic needs fulfilment: a chair that supports your weight and doesn’t topple over; more than desirable features, such as back and height adjustment of an office chair; it’s the Eams Executive Chair or a Walter Knoll Elton chair… a blend of several characteristics, which resonate with the customer and evoke an emotionally positive response.

However, the phrase, “doesn’t live up to expectations” is where QL is present, but where basic quality (QTbase) is not. We must be careful not to confuse QL quality with design excellence.

Through analysis, supported by design of experiments and customer validation, we can build an understanding of key physical characteristics and their effective ranges, which evoke this positive emotional response.

The more complex a product, the greater the number of associated emotional responses: the “wow!” and “delight.”

You’ve decided to purchase a product or in this example, a service.

Imagine you are travelling to a German city and, as an exercise, decide to book a hotel room for the night, yourself, over the phone. You are offered a room rate, at higher price than online and in condescending manner, from a 5* Hotel Chain.

Your negative emotional reaction (anger) would generate four consequences:

One industry example

Sustainable Value to Satisfy multiple customers

Healthcare industry: The big-pharma product triple jump of three market customers

Value creation through new personalised medicine pathways: In the costly development of new drugs, even at late clinical trial stages, promising products fall by the wayside. But some of these products could, in the light of personalised medicines and pharmacogenomics, become valuable and safe treatments.

The question to the industry is, can big pharma gain governmental legal support to develop and protect (patent) these focused treatments by demonstrating the value of patient RNA/DNA testing in combination with more specialised treatments?

The answer lies with the original requirement to demonstrate that a product is ‘safe.’ Safe to use for the appropriate audience and safely and cost efficiently compounded if required. Just as cars require infrastructure of roads and fuel to be viable transport systems, so do personalised medicines require new low-cost, exceptionally accurate test-kits to fuel their uptake, as sales enablers.

Mid-market pressure and successful relationship development with authorities, management of drug trial approvals, more streamlined procedures, and the B2B Brand recognition allowing follow-up or future new products easier entry into a receptive market and drug approvals scenario.

This narrow focus approach poses risks and is susceptible to change on two fronts:

- Front-end change in consumer respect for a narrow brand vs a universally trusted company, if competition can drive their influence through the front-end

- A step changes in procedures such as a political demand for a level playing field, where inappropriately tight relationships are seen to have developed